KIP: KARRAT Liquidity Vault Funding Preparation

KIP Type: Non-Constitutional KIP

Abstract

$401,000 USD worth of KARRAT, calculated at the time of transfer from the KARRATco treasury wallet, dispersed to the SubDAO wallet. This KIP proposes to allocate $400,000 in KARRAT from the KARRAT DAO treasury, along with $500 for gas fees and $500 for establishing a Delaware LLC for MPH SubDAO multisig protection, to prepare funding for a future $400,000 KARRAT liquidity vault on Uniswap v4 using Arrakis Pro. The vault will not be activated until $5000 USD ETH conditions are met. Managed by the MPH SubDAO Working Group multisig, the vault aims to ensure stable, long-term liquidity for the KARRAT token, aligning with the community-owned ecosystem goals.

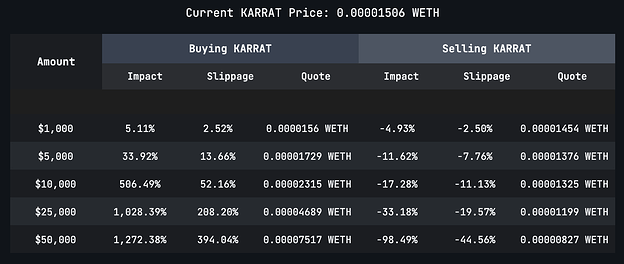

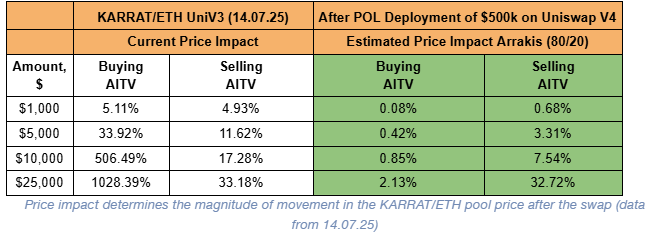

MotivationPrice Impact Analysis for the KARRAT liquidity pool (dated 14.07.2025) on Uniswap v3 shows significant price impact for swaps of $1,000 or more due to limited on-chain liquidity, restricting trading capacity and deterring larger participants.

Traditional liquidity mining creates temporary “rented” liquidity and sell pressure. This proposal prepares funding for Protocol-Owned Liquidity (POL) using Arrakis Pro to enable stable, long-term liquidity once ETH acquisition conditions are met.

Rationale

This KIP secures funding for a future DAO-owned liquidity vault, eliminating reliance on emissions and sell pressure. Arrakis Pro’s non-custodial, algorithmically managed strategy on Uniswap v4 offers up to 10x capital efficiency, minimal slippage, and impermanent loss protection via audited contracts. Real-time analytics and MPH SubDAO governance will ensure transparency and effective management once the vault is activated.

The $500 allocation for a Delaware LLC provides legal protection for the MPH SubDAO Working Group multisig, which will manage the vault. A Delaware LLC is a common structure for DAOs and DeFi projects due to its flexible governance, limited liability for members, and favorable legal framework. This protects multisig signers from potential personal liability related to vault operations, regulatory uncertainties, or disputes, enhancing the DAO’s operational security and compliance.

Key Terms

-

POL: Protocol-Owned Liquidity managed by the DAO.

-

Arrakis Pro Vault: Hybrid active liquidity strategy, DAO-controlled.

-

Multisig: Multi-signature wallet governed by MPH SubDAO Working Group.

-

Delaware LLC: Legal entity to protect MPH SubDAO multisig signers from liability.

Specifications

-

Total Funding Allocation: $401,000 USD

-

Vault Funding: $400,000 USD in KARRAT (treasury, held until vault activation)

-

Platform: Uniswap v4 with Arrakis Pro Private Vault (upon activation)

-

Vault Control: MPH SubDAO Working Group multisig

-

Funding Source: 100% KARRAT from DAO treasury

-

Gas Fees: $500 USD in KARRAT for operational and transaction costs (upon vault activation)

-

Legal Protection: $500 USD in KARRAT for establishing a Delaware LLC

-

Vault Ownership: Fully DAO-owned, non-custodial (upon activation)

-

Activation Condition: Vault will not be started until further conditions regarding ETH acquisition are met.

-

Contingency Provision: If a KIP to market sell $100,000 USD of KARRAT fails to pass, MPH SubDAO will market sell KARRAT allotted from this KIP to obtain $5,000 USD worth of ETH for vault activation.

Arrakis Pro Overview

Arrakis Pro is a non-custodial liquidity platform managing over $2 billion in trading volume for DAOs like MakerDAO, Lido, and Kwenta as of 2025. Its hybrid architecture will ensure efficiency for KARRAT DAO’s $400,000 vault upon activation.

Key Advantages:

- Security: Audited contracts by Trail of Bits and OpenZeppelin, funds in MPH SubDAO multisig.

- Uniswap v4 Efficiency: Single pool design saves ~30% on gas; real-time tools reduce price swings.

- Capital Efficiency: Upto 10x better, e.g., Gelato (66% volume with 25% TVL).

- No Emissions: Organic trading avoids sell pressure.

- Governance: Real-time dashboard and multisig updates for transparency.

- Revenue: Retains 50% of trading fees (at 1% tier).

- Scalability: Deployed on multiple EVM chains including Base, Arbitrum, BNB, Polygon, Unichain, Optimism, etc. with support for multiple DEX frameworks like Uniswap, Aerodrome, Pancakeswap and Velodrome.

- Future-Proof: Fully compatible with custom Uniswap v4 hooks.

Learn more: https://www.arrakis.finance/

Historical Performance Examples with Arrakis Pro

- Kwenta (KWENTA/WETH): Started with 5% ETH, grew to ~67%. Read more: https://mirror.xyz/0x929fCf268A62e684221f1e39B8b6ddA2f0dA4AeC/GzkTmH8MRlcw7QkgdHZh5M9jIyfGbnfgkzGJfkSo_io

- Gelato (GEL/WETH): Started at 8% ETH, reached 42–55%, facilitated 66% volume with 25% TVL. Read more: https://mirror.xyz/0x929fCf268A62e684221f1e39B8b6ddA2f0dA4AeC/GzkTmH8MRlcw7QkgdHZh5M9jIyfGbnfgkzGJfkSo_io

- Perpetual Protocol (PERP/WETH): Outperformed hold by ~1%, supported 36% volume with 2.9% TVL. Read more: https://mirror.xyz/0x929fCf268A62e684221f1e39B8b6ddA2f0dA4AeC/GzkTmH8MRlcw7QkgdHZh5M9jIyfGbnfgkzGJfkSo_io

- Parallel DAO (MIMO/WETH): Achieved 50/50 balance without incentives, reducing slippage. Read more: https://mirror.xyz/blog.mimo.eth/NPYvu5Dg01LcHlEjLaKLnShTtaX6Gp2esWb5keCsgJQ?utm

Steps to Implement

-

Allocate Funds: Reserve $400,000 USD in KARRAT from the treasury for the future vault.

-

Fund Delaware LLC: Allocate $500 USD in KARRAT to establish a Delaware LLC for MPH SubDAO multisig protection.

-

Cover Gas Fees: Reserve $500 USD in KARRAT for operational and transaction costs, to be used upon vault activation.

-

Await ETH Acquisition Conditions: Monitor and announce progress on ETH acquisition conditions in the My Pet Hooligan Discord.

-

Vault Activation: Upon meeting ETH conditions, deposit KARRAT into the vault and launch Arrakis Pro strategy (subject to future governance approval).

-

Contingency Plan: If a KIP to market sell $100,000 USD of KARRAT fails to pass, MPH SubDAO will market sell KARRAT to obtain $5,000 USD worth of ETH to activate the vault

Timeline

-

Week 1: Reserve KARRAT funds and initiate Delaware LLC setup.

-

Week 2+: Await ETH acquisition conditions, with updates shared in the My Pet Hooligan Discord.

Timelines for vault activation depend on ETH acquisition conditions and may shift due to technical setup, LLC formation, or governance processes.

Fees

-

Annual Management Fee: 1% of assets under management (AUM), charged by Arrakis Pro upon vault activation.

-

Trading Fees: 50% of trading fees generated by the vault retained by Arrakis Pro upon vault activation.

Overall Cost

Total Cost to DAO Treasury: $401,000 USD, paid in KARRAT.

-

Vault Funding: $400,000 USD in KARRAT (reserved for future vault).

-

Gas Fees: $500 USD in KARRAT (reserved for vault activation).

-

Delaware LLC: $500 USD in KARRAT for legal protection of MPH SubDAO multisig.

Notes

-

The vault funding is reserved with 100% KARRAT from the treasury, ensuring full DAO control, but activation awaits further conditions related to ETH acquisition.

-

If a KIP to market sell $100,000 USD of KARRAT fails to pass, MPH SubDAO will market sell KARRAT allotted from this KIP to obtain $5,000 USD worth of ETH for vault activation.

-

The Delaware LLC protects MPH SubDAO multisig signers from potential personal liability arising from future vault management, regulatory uncertainties, or legal disputes. Delaware’s favorable LLC laws provide limited liability, flexible governance, and a robust legal framework, making it a standard choice for DAOs and DeFi projects to enhance operational security.

-

Eth acquisition plan: Treasury Sale to Fund ETH for DAO Vault